Field of Research

Empirical Industrial Organization

Research Topics

1: Analyses of the effects of uncertainty on procurement costs

2: Empirical analysis based on models of auction, bargaining, and price discrimination

Overview of Research

It is often difficult for a client to precisely evaluate the quality of a proposal in a procurement setting. For instance, a client may not be capable of judging the quality of a website structure and/or its layout proposed by a web designer. When designers compete in such environment, they need to propose a design without knowing how their design will be evaluated.

While the type of uncertainty in evaluation like the above is prevalent, ranging from the procurement of military weapons to the assessment of academic research proposals, there is no empirical evidence documented on this matter thus far. How does uncertain evaluation of proposals affect the behavior of designers and the outcome of design competition?

Takahashi (RAND, 2018) investigates a sample of public infrastructure procurement auctions in Florida, and document evidence of large discrepancy in design evaluations among reviewers. Further, we quantify how much uncertainty the designers (i.e., construction consultants) face via the lens of a structural model. Lastly, we examine the impacts of uncertain evaluations on bidding strategies and procurement outcomes.

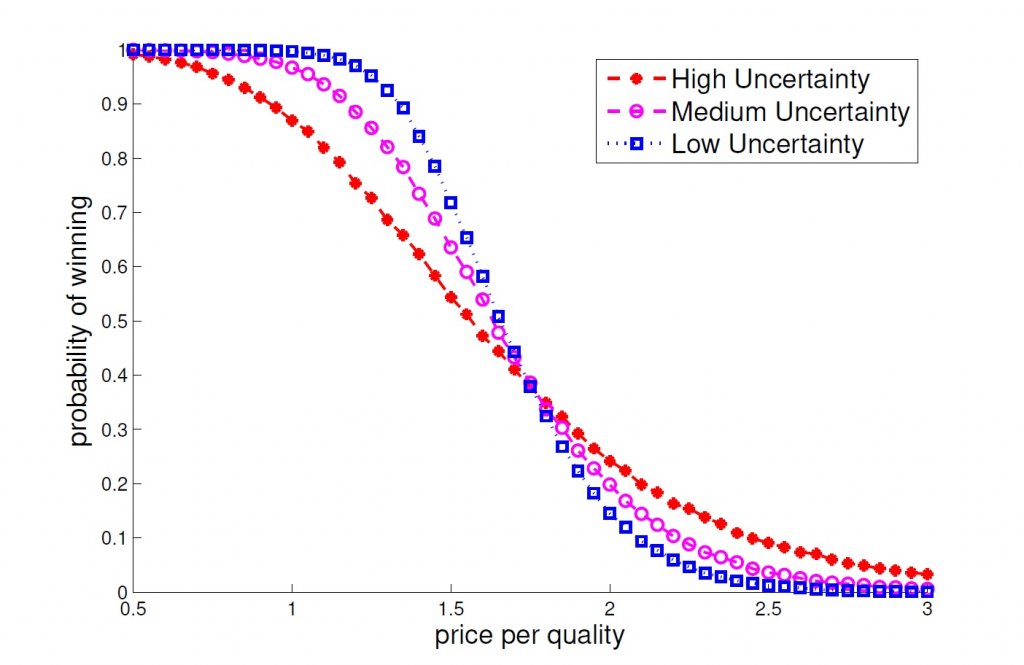

Figure 1 shows how the likelihood of winning a contract (from the view of a bidder) changes with respect to the degree of uncertainty involved in reviewers’ design evaluations. When the uncertainty is large, poor designs have a greater chance of winning while good designs have a lower chance of winning. Therefore, an increase in the uncertainty generates an incentive to propose a bad design since a good design is likely to involve large construction costs.

Based on obtained estimates, we decompose the impacts of evaluation uncertainty on procurement costs into a direct effect and an indirect effect. The direct effect of evaluation uncertainty is the effect of random evaluation replacing the winner in an auction. The indirect effect is the effect of evaluation uncertainty that changes the bidding strategies of participating firms. We found a large indirect effect in the data, which suggests that even at seemingly small level of randomness may increase the cost of procurement via an increase in the procurement cost.

TAKAHASHI, Hidenori

Associate Professor

Degree: Ph.D. in Economics (Toronto University)

takahashi@osipp.osaka-u.ac.jp